The steps to pay your tax liability under GST are

STEP 1:

Go to the website https://www.gst.gov.in/

STEP 2:

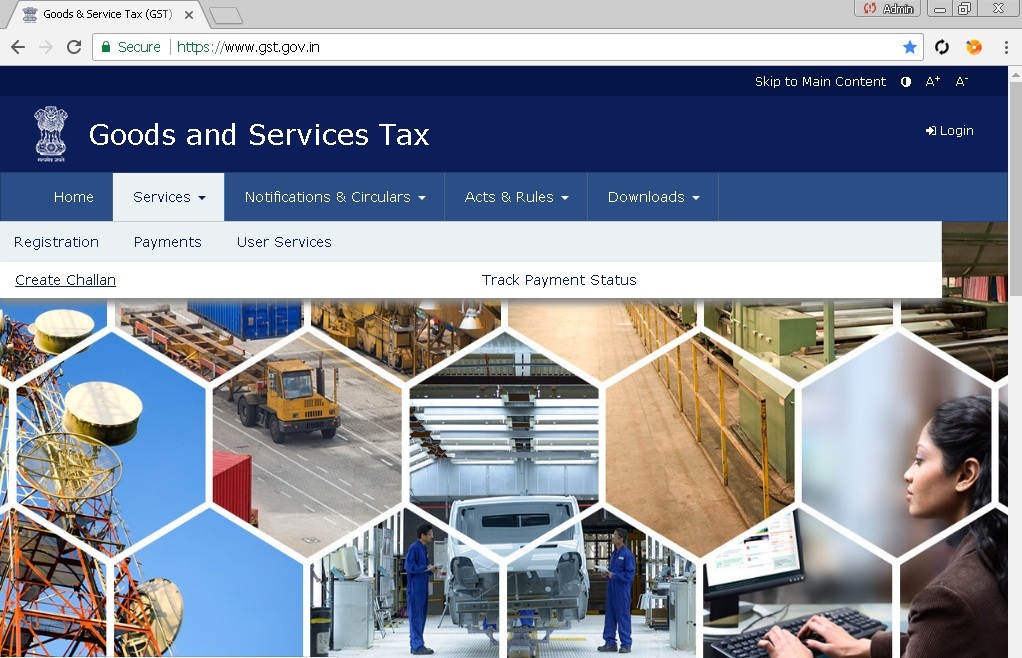

On the website under the create challan option is to be clicked.

It is available under Payment option.

The payment option further is under the services tab

STEP 3:

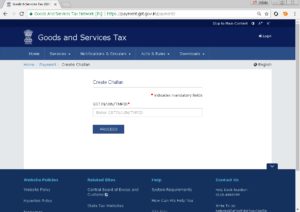

After clicking on create Challan you will see the following screen.

Enter the GSTIN for which GST is to be paid

Then you would need to enter the captcha code.

After that click “Proceed”

STEP 4:

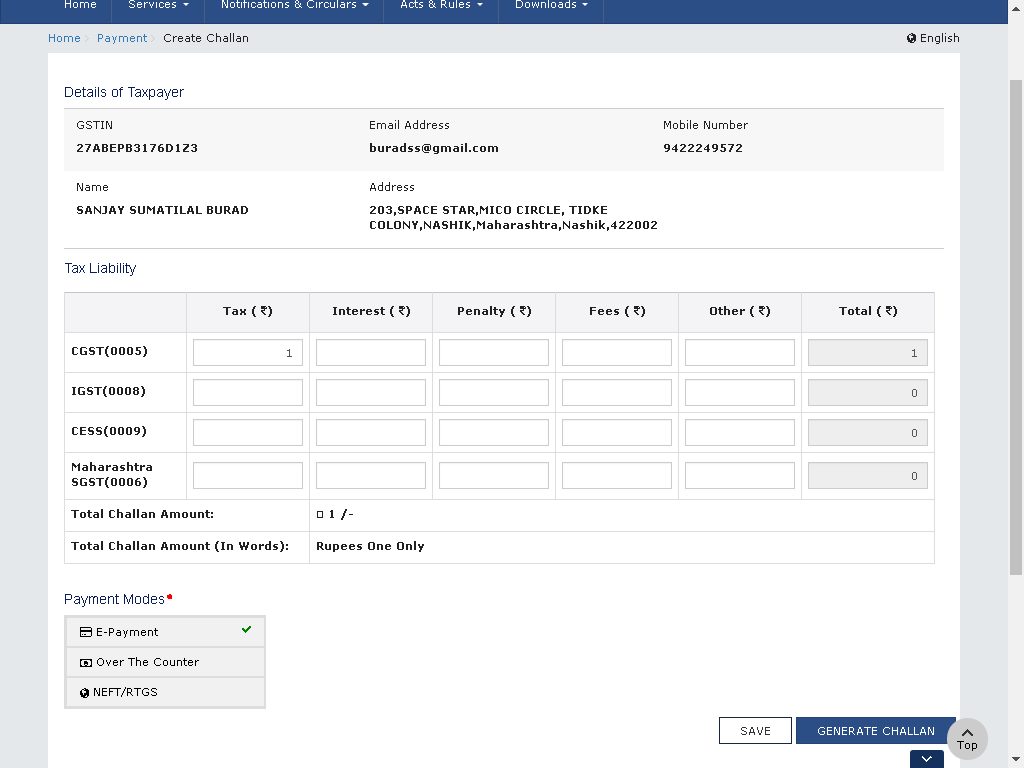

After entering GSTIN and the captcha code the challan screen would appear as shown in the image below.

Enter the GST amount you wish to pay in the respective fields under “Tax Liability”. The amounts of CGST, IGST, Cess and SGST are to be entered carefully. Depending on the state you are registered in the relevant SGST field would appear.

Select the payment mode. The “Over the counter” payment mode involves direct deposit of cash via a Bank. This mode is available only for total amount of up to Rs 10,000/-.

STEP 5:

After entering the amounts and selecting the payment mode, the Generate Challan button shall get activated.

On clicking the “Generate Challan” button you will be asked for OTP. The OTP is sent on the registered email id and mobile number. The email id and mobile number to which OTP are sent is mentioned on the top of challan under “Details of Taxpayer”.

After entering the OTP, challan shall be generated and you shall be directed to the payment gateway if e-payment option is selected.

Note:

You may track the payment status under “Track Payment Status” .The GSTIN and CPIN (i.e. challan number) need to be entered.

Aug 19, 2017 - GST - Team SSB