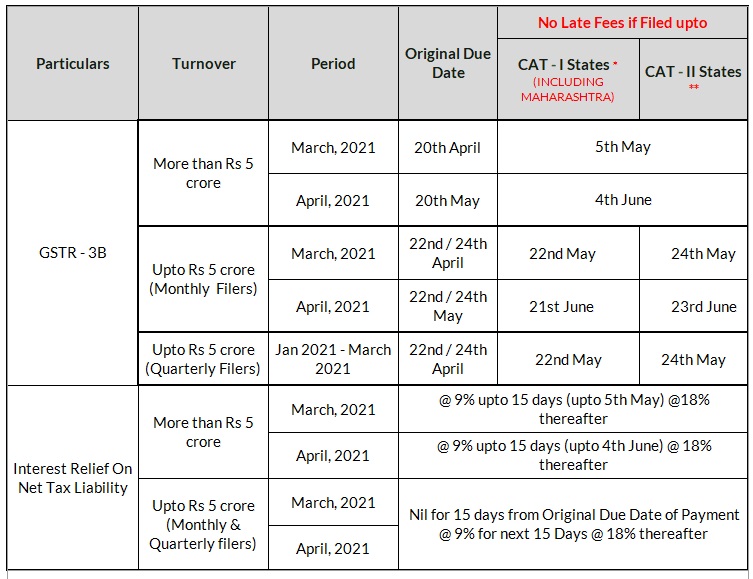

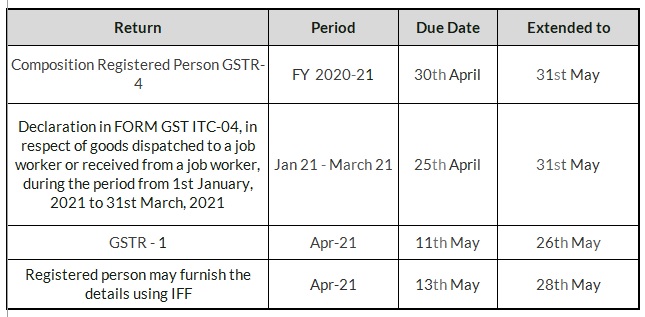

The article covers the recent relaxation in GST compliances due to Coivd-19 pandemic.

GST Returns

Rule 36(4) will apply cumulatively for April & May in GSTR-3B of May.

As per Rule 36(4) ITC can be availed up to maximum 5% of the ITC reflected in Form GSTR 2A/2B.

*Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands or Lakshadweep

**Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi

(The above has been notified vide Notification No. 08/2021- Central Tax Dated 01.05.2021, Notification No. 09/2021- Central Tax Dated 01.05.2021, Notification No. 10/2021- Central Tax Dated 01.05.2021, Notification No. 11/2021- Central Tax Dated 01.05.2021, Notification No. 12/2021- Central Tax Dated 01.05.2021, Notification No. 13/2021- Central Tax Dated 01.05.2021 )

Other Compliances

Where, any time limit for completion or compliance of any action, by any authority or by any person, has been specified in, or prescribed or notified under the said Act, which falls during the period from the 15th April, 2021 to the 30th May, 2021, and where completion or compliance of such action has not been made within such time, then, the time limit for completion or compliance of such action, shall be extended up to the 31st May, 2021, including for the purposes of

- Completion of any proceeding or passing of any order or issuance of any notice, intimation, notification, sanction or approval or such other action, by whatever name called, By any authority, commission or tribunal, by whatever name called, under the provisions of the Acts stated above; or

- Filing of any appeal, reply or application or Furnishing of any report, document, return, statement or such other record, by whatever name called, under the provisions of the Acts stated above;

But, such extension of time shall not be applicable for the compliances of the following provisions of the said Act, namely:

- Chapter IV :- Time And Value of Supply

- Section 10(3) :- Composition Person to Normal Person

- Sections 25 :- Registration

- Section 27 :- Causal Taxable Person & Non Resident Taxable Person

- Section 31 :- Tax Invoice

- Section 37 :- Furnishing Detail of Outward Supplies

- Section 47 :- Levy of Late Fees

- Section 50 :- Interest on Delayed Payment of Tax

- Section 69 :- Power to Arrest

- Section 90 :- Liability of Partners of Firm to Pay Tax

- Section 122 :- Penalty for Certain Offences

- Section 129 :- Detention, Seizure & Release of goods & Convey. in Transit

- Section 39 :- Filing of Return except TDS, ISD & NRTP Returns

- Section 68 :- In so far as e-way bill is concerned

- Rules made under the provisions specified at (1) to (4) above.

(The above has been notified vide Notification No. 14/2021- Central Tax Dated 01.05.2021)

Rejection of Refund Claim

In cases where a notice has been issued for rejection of refund claim, in full or in part and where the time limit for issuance of order in terms of the provisions of sub-section (5), read with sub-section (7) of section 54 of the said Act falls during the period from the 15th April, 2021 to the 30th May, 2021, In such cases the time limit for issuance of the said order shall be extended to

- 15 days after the receipt of reply to the notice from the registered person OR

- 31st May,2021

whichever is later

May 05, 2021 - Blog - Team SSB