GST mentions when and who is required to prepare a tax invoice. Every person who is registered under Goods and Service Tax shall issue a tax invoice when he is supplying goods or services.Though an invoice need not be issue if value of goods or services supplied is less than Rs 200.

The invoice issued should contain certain details such as

- GSTIN, Name and address of supplier

- Invoice number and Date of issue

- Name and address of recipient

- GSTIN of recipient (if registered)

- HSN Code or Accounting Code

- Description,Value, Tax rate and tax amount of goods/services

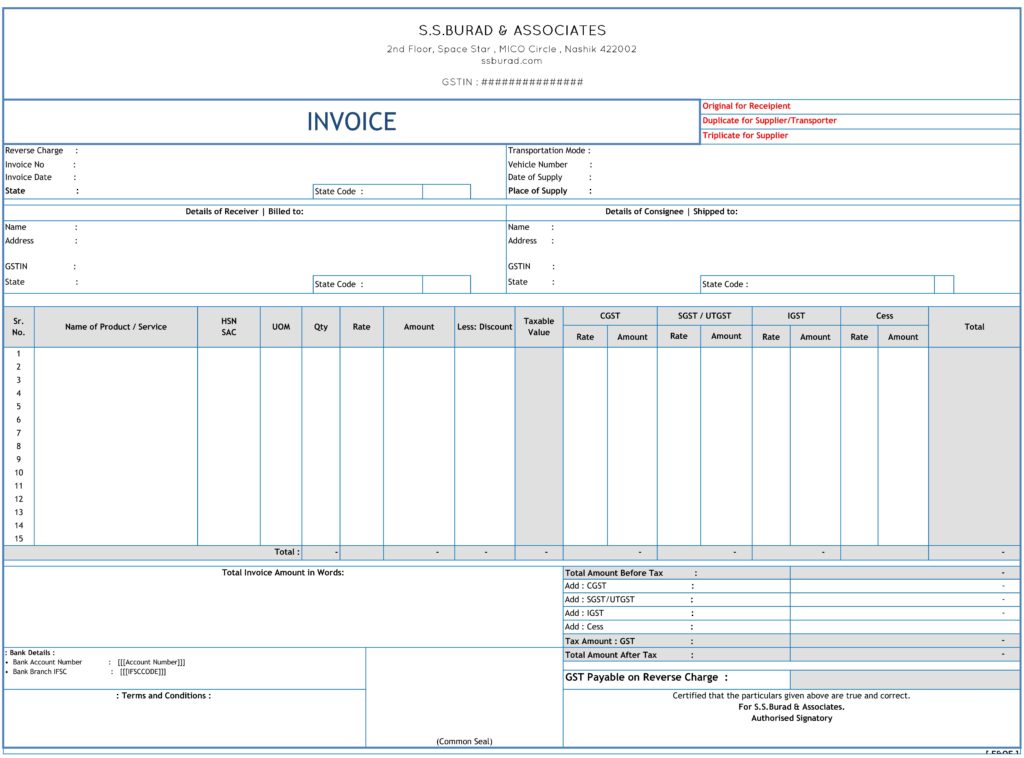

The format of invoice for supply of goods/service or single service can be seen below

A Draft GST Invoice Format for supply of goods / services :

UPDATE :

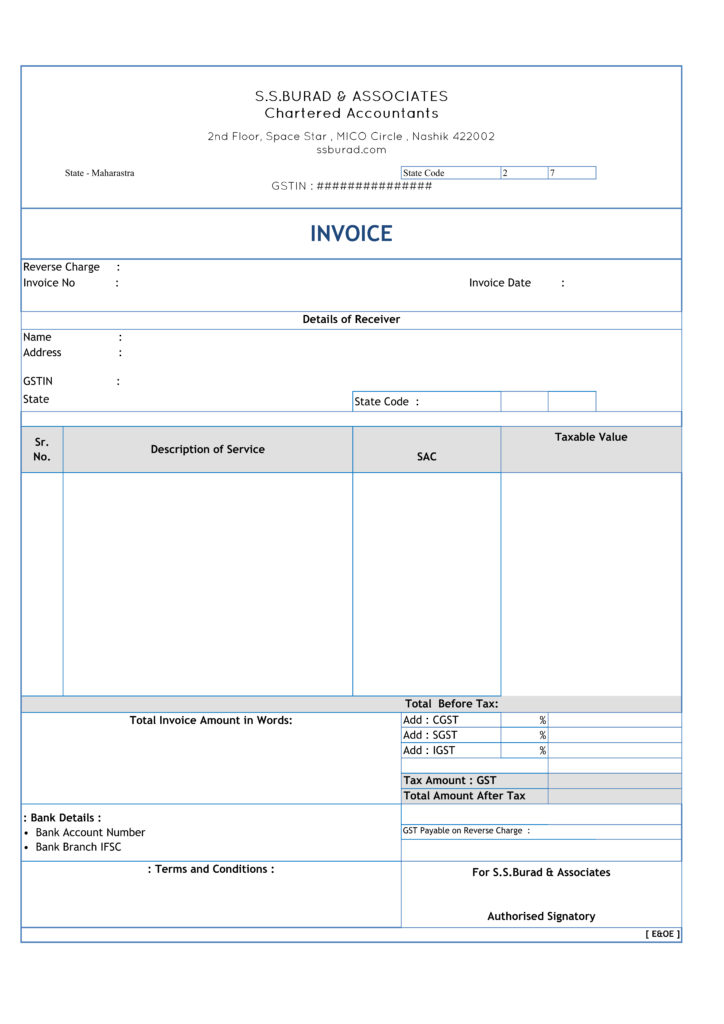

Incase of single service is provided a simplefied format may also be used.

Jun 27, 2017 - GST - Team SSB